Despite economic challenges like rising interest rates and market volatility, the M&A market in 2024 remains robust, driven by the demand for digital transformation, ESG integration, and improved supply chain resilience. Companies are more cautious, focusing on strategic acquisitions that align with long-term goals to ensure value creation.

Success in this environment requires meticulous planning and adaptability, with firms prioritizing agility and thorough due diligence. By doing so, they aim to navigate the complexities of the current landscape, ensuring that transactions not only close but also deliver sustainable growth.

The first half of 2024 has seen a dynamic shift in the M&A landscape. While uncertainties linger, strategic dealmakers are leveraging new opportunities to drive growth, resilience, and innovation. This report highlights the key trends, emerging opportunities, and strategic considerations for M&A in today’s volatile environment.

Market Rebound Amidst Uncertainty

After a challenging 2023, M&A activity is gradually recovering, driven by stabilizing economic conditions and strategic imperatives. Key factors influencing this rebound include:

- Resilient Sectors: Industries like technology, healthcare, and energy continue to show strong M&A activity, driven by innovation and the need for sustainability.

- Capital Availability: Despite rising interest rates, abundant dry powder from private equity, sovereign wealth funds, and corporates is fueling dealmaking.

- Price Stabilization: The gap between buyer and seller price expectations is narrowing, leading to increased transaction volumes.

Strategic Focus Areas

To navigate the complexities of the current market, companies are focusing on several strategic areas:

- Portfolio Optimization: Companies are reshaping their portfolios through divestitures and acquisitions, aiming to focus on core strengths and enter high-growth sectors.

- Digital Transformation: M&A is increasingly driven by the need to acquire digital capabilities, particularly in areas like AI, cybersecurity, and data analytics.

- Sustainability and ESG: Environmental, Social, and Governance (ESG) factors are playing a pivotal role in M&A decisions, with companies seeking to enhance sustainability and meet regulatory requirements.

Emerging opportunities

The evolving market landscape presents several emerging opportunities for dealmakers:

- Cross-Border Deals: As companies seek to strengthen supply chain resilience and access new markets, cross-border M&A is on the rise.

- Transformational Deals: With capital scarcity, there is a growing focus on transformational deals that can reshape industries and drive long-term growth.

- Regulatory Changes: Evolving regulations, particularly in data protection and antitrust, are shaping the M&A landscape, offering both challenges and opportunities.

Looking Ahead

As we move into the second half of 2024, M&A activity is expected to continue its upward trajectory. Dealmakers who remain agile, strategic, and forward-thinking will be best positioned to capitalize on the opportunities in this evolving market.

The M&A landscape in 2024 is marked by both challenges and opportunities. Companies that prioritize strategic focus areas such as digital transformation, sustainability, and portfolio optimization will be well-equipped to navigate the complexities of the current market and drive successful outcomes.

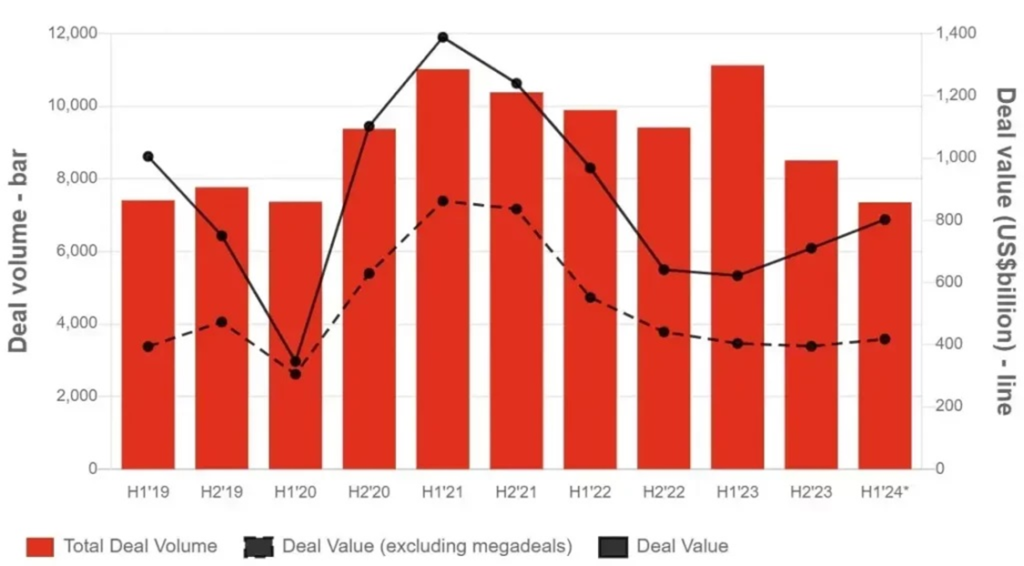

Deal Volumes and Values Americas, 2019 – H1 2024

Sources: LSEG and PWC